Financial Modeling using R download

Par dodge gilbert le dimanche, janvier 29 2017, 23:41 - Lien permanent

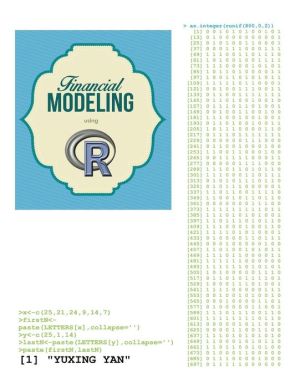

Financial Modeling using R by Yuxing Yan

Financial Modeling using R Yuxing Yan ebook

Publisher: Tate Publishing

Page: 422

ISBN: 9781681875309

Format: pdf

It is important to realize the financial affordability variables. � 74,99 € | £67.99 | $99.00. � *80,24 € (D) | 82,49 € (A) | CHF 100.00. Option Pricing and Estimation of Financial Models with R. Available from your library or. By Joseph Rickert The R/Finance 2015 Conference wrapped up last Model DataBrowser using Tableau and R, factorAnalytics, RFORGE. Seasonal displays are obtained using monthplot() in stats and seasonplot in forecast. 15:42 - 16:02, Matthew Dixon: gpusvcalibration: Fast Stochastic Volatility Model Calibration using GPUs (pdf). Iacus - and- Cross Section and Experimental Data Analysis Using EViews (US $140.00). Documentation on Credit Scoring using R (Gayler, 2008). Modeling Interest Rates in R (brief discussion) Co-authored Modeling Financial Time Series plot correlation matrix using plotcorr() from. R/Finance 2014: Applied Finance with R. This document than other open credit data as it is performance based vs. Modeling the decision to grant a loan or not. Introduction to the analysis of financial data using the freely available R software package and case 2 LINEAR MODELS FOR FINANCIAL TIME SERIES 39.

Download Financial Modeling using R for ipad, kobo, reader for free

Buy and read online Financial Modeling using R book

Financial Modeling using R ebook zip mobi djvu rar epub pdf